This page provides a transparent overview of the Tree Tops Subdivision Common Trust’s financials, including billing, balances, and tax summaries.

Bank Balance Information

| Saving Bal Min $300 to avoid fees | Checking Bal Min $500 to avoid fees |

| $4,300 | $876 |

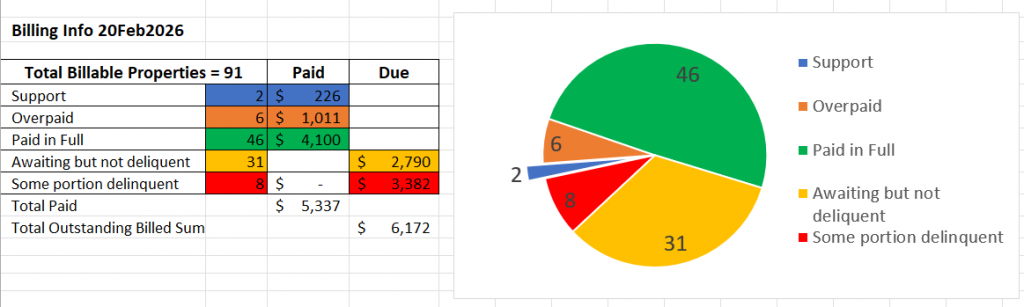

Billing Status Update – Tree Tops Subdivision Common Trust (TTSCT)

As of November 1, 2025:

- 91 homes are officially deeded into the TTSCT.

- Billing has been issued only to these homes.

📊Financial Review & 2026 Planning

Following completion of the 2025 tax filings and annual summary (October 2025), it’s clear that an increase in the billing rate is necessary to maintain responsible operations and reserves.

2026 Rate: $95 per year per household

(equivalent to $8/month if paid monthly)

We have two houses in a support category for the Detention Basin – If your house isn’t in the Deed Trust, please send a letter/with a check to the Billing Address and indicate the desire to support the Detention Basin.

Billed Payments Requested by 01March2026, there is provision in the Trust document to add on up to 15% for payments delinquent by 15 days.

Mar 15, 2025, there are 2 houses in the Tree Tops Subdivision Common Trust that have Judgements from the Berks County Magisterial District Judge System that have not been marked as satisfied. In February/March, four houses have had current judgements satisfied and paperwork completed.

One other note, the PayPal online Billing capability was used 5 times in the 2025 billing cycle, it was relatively painless from the Trust side, I don’t expect it to change for next year. This QR Code will point you to PayPal for the Tree Tops Account, if used please add 3% to cover the PayPal fees.

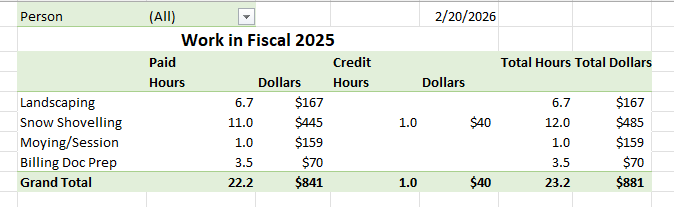

Billing in Fiscal Year 2025

Summary of the work completed and paid in Credit and Check by category, some estimates of future work.

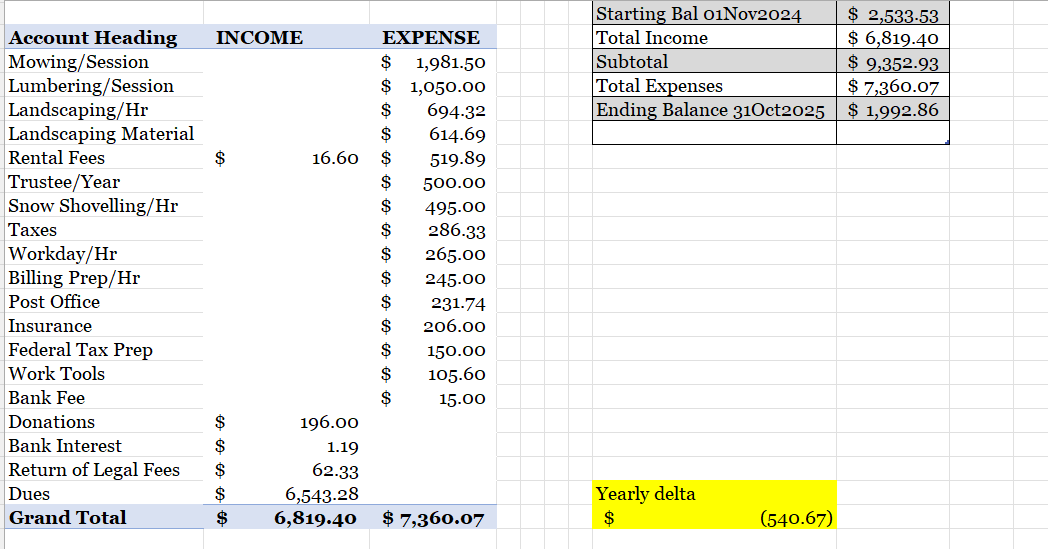

Taxes for 01Nov2024 – 31Oct2025

I wanted to share a breakdown of expenses and income for Fiscal Year 2024. This gives a clear picture of how things played out financially over the year — what came in, what went out, and how it all balanced.

If you have any questions or want to dig into any specific category, I’m happy to walk through it with you.